What is an escrow shortage?

What is an escrow shortage?

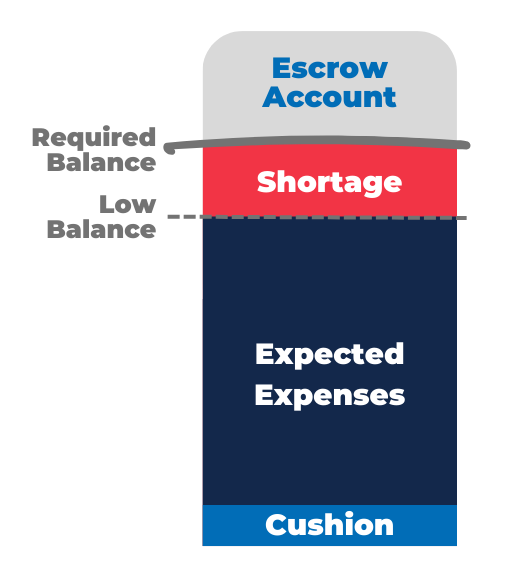

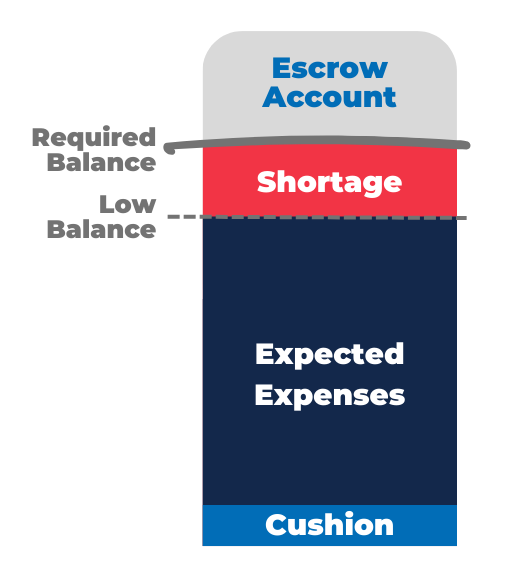

All escrow accounts have a minimum required balance, which equals your expected tax and insurance expenses plus some extra money in case your bills go up – this is called a cushion. If your escrow account balance is expected to dip below the minimum required balance in the upcoming 12 months, you have a shortage. In other words, your escrow account will not have enough funds for the upcoming year unless you increase the balance.

How did I end up with a shortage?

Reasons you do not have enough money in your escrow account to meet the minimum balance may include:

- Increase in the rate of your insurance premium.

- Your property value was reassessed, leading to a change in property taxes due.

- Change in your insurance provider or policy.

- Change in the due date of your property taxes and/or insurance premiums.

- Your payments into your escrow account were fewer or less than expected.

- Starting escrow balance for the upcoming year is lower than expected due to higher expenses in the prior year.

How is a shortage calculated?

How is a shortage calculated?

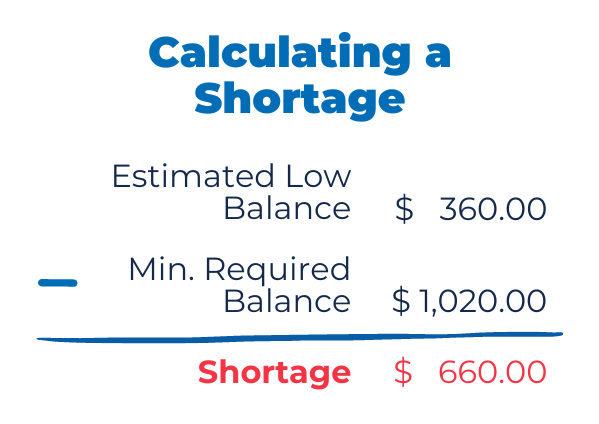

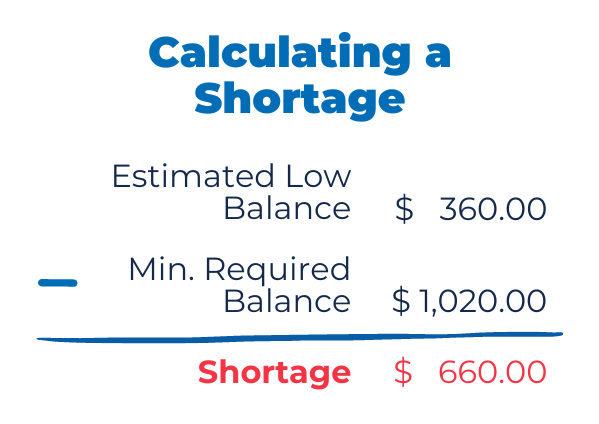

The difference between the low balance and the required balance shows the amount of your escrow shortage. For example, see the calculation on the right with sample data. If your Escrow Account Disclosure Statement shows a shortage, the section titled Expected activity in the upcoming year shows exactly how we calculated it.

What do I need to do?

It is necessary to repay the shortage to help ensure your escrow account satisfies the minimum required balance.

Some good news: You don’t have to repay a shortage immediately or all at once. A shortage is automatically spread across your upcoming mortgage payments, typically for 12 months. The first page of your escrow statement provides the date on which you need to begin making your mortgage payments in the new amount.

If you want to minimize the increase in your monthly payment, you can choose to make a lump sum payment at any time to reduce or fully repay the shortage. This is not required; we offer the option for those who want to keep their monthly mortgage payment as low as possible. If you choose to pay down your shortage, the new monthly mortgage payment provided on the first page of your escrow statement will be reduced.

How can I make a lump sum shortage repayment?

If you opt to repay some or all of your shortage, you can choose from the following payment options:

- Online: Log into your account via our website or app, go to Payment, select other payment types, and enter your chosen amount into the additional escrow field.

- By Phone: Call Customer Care.

- By mail: Send a check to our Payments address. Be sure to write “escrow shortage repayment” and your loan number on the check.

If I repay my shortage in full now, will my monthly payment still increase?

Repaying your shortage in full will not prevent your monthly payment from increasing. If your tax and/or insurance expenses have increased, it is necessary to increase your monthly payment amount to cover your upcoming bills.

At least once per year, we are required to update the amount of your monthly payment every 12 months based on the amount of your tax and/or insurance expenses in the prior 12 months. If your expenses change, the amount you pay into your escrow account each month as part of your monthly mortgage payment needs to be adjusted accordingly. This can help prevent or lessen a shortage next time your escrow account is reviewed.

What do I need to do if my payment changes?

It is important to note your new monthly mortgage payment amount and effective date provided in your escrow statement and to adjust your payment accordingly.

If your monthly mortgage payment is set up for automatic payments (monthly or biweekly ACH drafts) through us, your draft settings will automatically update with the new amount of your monthly mortgage payment on the effective date. If you make your mortgage payments through a third-party entity (e.g. bank, government allotment, biweekly, or bill-pay service), be sure to update your payment settings to the new amount.

Can I prevent a shortage from occurring in the future?

Since tax and insurance expenses can change without advance notice, shortages are not always preventable. However, keeping track of your escrow account activity can help you minimize a shortage in the future. If a tax or insurance bill paid out of your escrow account increases from the prior year, you could opt to pay the difference into your escrow account at that time. This will help ensure your escrow balance meets the requirement.

If you have provided us with your email address and have not opted out of receiving emails from us, we will send you an email each time a tax and/or insurance bill is paid on your behalf. You can also log into our website or app to review your escrow activity anytime.

I am concerned about repaying the shortage and/or the new monthly mortgage payment. What should I do?

If you anticipate these changes could lead to financial hardship, we want to help. Please reach out to our Homeowner Assistance Team. We will guide you on mortgage assistance options available, how to apply, and what to expect.

What is an escrow shortage?

What is an escrow shortage? How is a shortage calculated?

How is a shortage calculated?