What is an escrow surplus?

What is an escrow surplus?

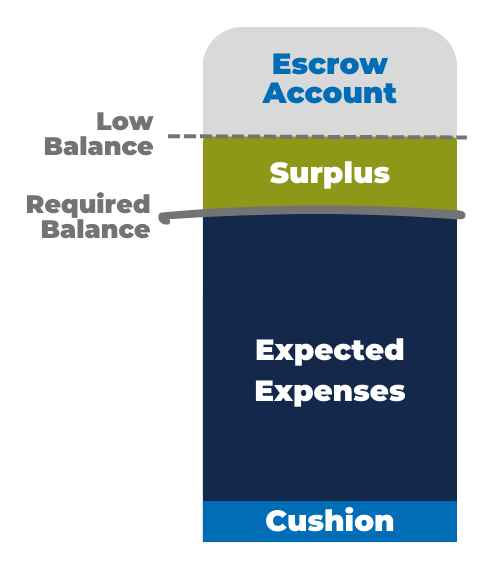

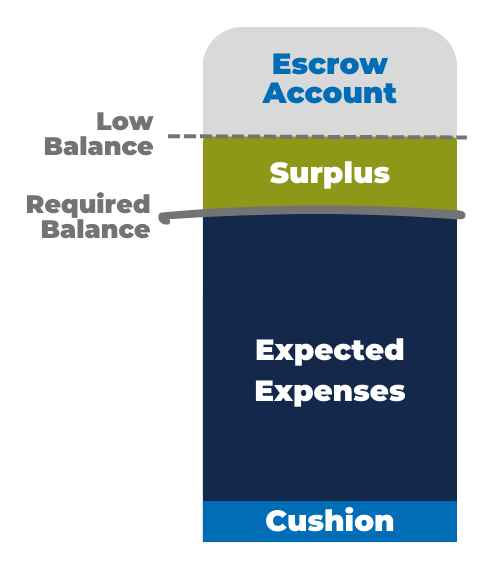

All escrow accounts have a minimum required balance, which equals your expected tax and insurance expenses plus some extra money in case your bills go up – this is called a cushion. If your escrow account balance is more than the minimum required balance, you have a surplus.

How did I end up with a surplus?

Your escrow account contains more funds than needed to cover your expected escrow expenses in the upcoming 12 months. This may be due to a decrease in your taxes and/or insurance expenses, or because you paid more money into your account than expected last year.

How is a surplus calculated?

How is a surplus calculated?

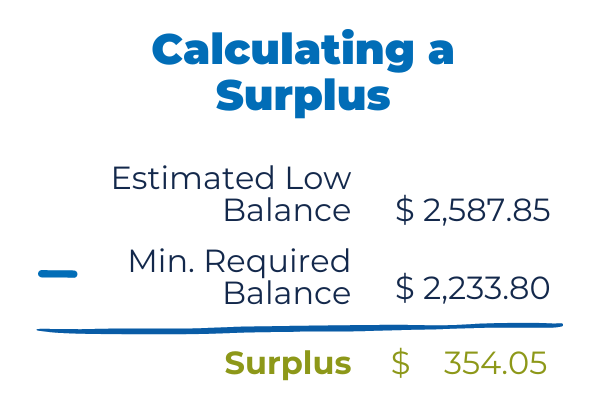

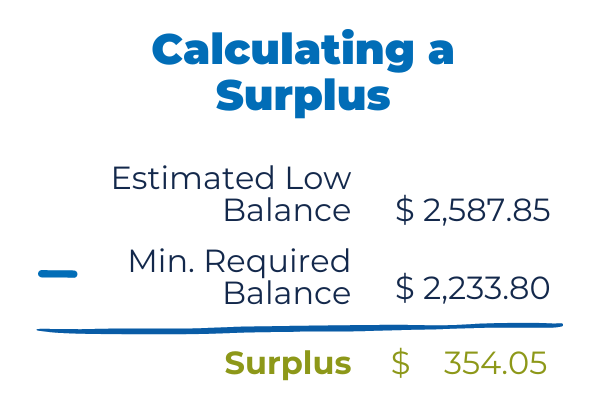

Subtracting the expected minimum required balance from the estimated low balance shows the amount of your escrow account surplus. For example, see the calculation on the right with sample data. If your Escrow Account Disclosure Statement shows a surplus, the section titled Expected activity in the upcoming year shows exactly how we calculated it.

What happens to the extra money?

If your escrow surplus is less than $50, a credit in the amount of your surplus will be automatically spread across your upcoming monthly mortgage payments.

If your escrow surplus is $50 or more, the amount of the surplus will be refunded to you.

A surplus of any amount may be retained if mortgage payments are past due or if the mortgage is in default or bankruptcy.

I have a surplus, but my monthly mortgage payment went up. Why?

Even if you have a surplus, we are required to update the amount of your monthly escrow payment every 12 months based on the amount of your tax and/or insurance expenses in the prior 12 months. If your expenses have changed, the amount you pay into your escrow account each month as part of your monthly mortgage payment must be adjusted accordingly.

I am concerned about the new amount due for my monthly mortgage payment. What should I do?

If you anticipate these changes could lead to financial hardship, we want to help you navigate mortgage assistance options available for your loan. Please reach out to our Homeowner Assistance Team.

What is an escrow surplus?

What is an escrow surplus?  How is a surplus calculated?

How is a surplus calculated?